Private Equity

Targets mature companies with reliable cash flows, unlocking value via operational improvements, strategic M&A and digital initiatives in less-crowded markets.

What is Private Equity?

Private equity generally refers to investments made in companies that are not publicly traded on a stock exchange or the acquisition of public companies with the intention of bringing them private. Unlike public market investments, Private equity generally involves active ownership, where General Partners work closely with portfolio companies to enhance operational efficiencies, drive innovation, and improve profitability. Private Equity investments typically have longer holding periods and are generally less liquid than publicly traded securities, but offer the potential for attractive capital appreciation at a fraction of the volatility exhibited by public equities.

Learn More About Our Private Equity Strategy

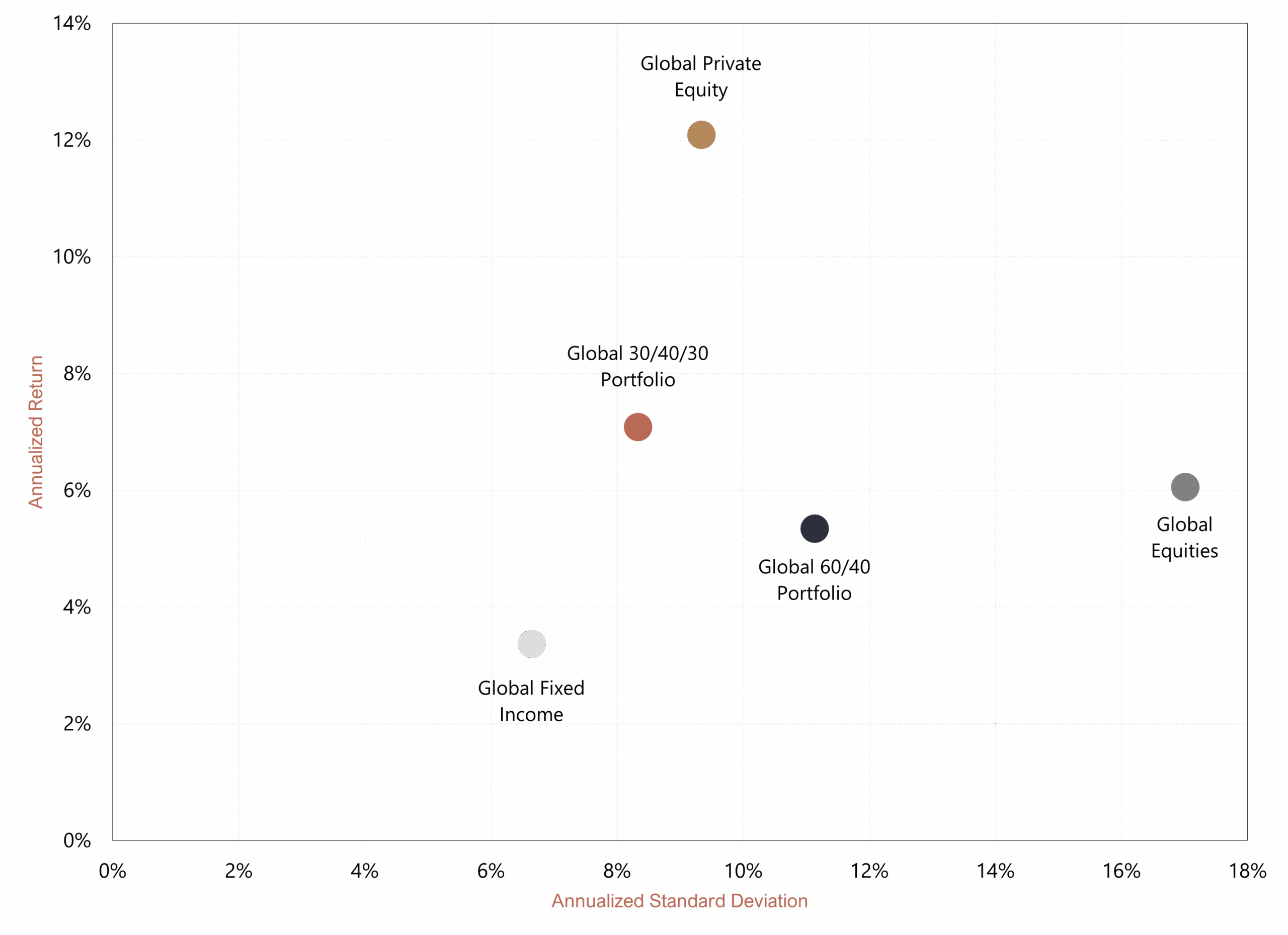

Data as of June 30, 2025. Source: PitchBook, Bloomberg, Westcourt analysis. Note: Global Equities is represented by MSCI World Net Total Return Index; Global Fixed Income by Bloomberg Global Aggregate Total Return Index. The “Global 30/40/30 Portfolio” is a hypothetical, unmanaged index and comprises 30% MSCI World Net Total Return Index, 40% Bloomberg Global Aggregate Total Return Index, and 30% Global Private Equity. The “Global 60/40 Portfolio” is a hypothetical, unmanaged index and comprises 60% MSCI World Net Total Return Index and 40% Bloomberg Global Aggregate Total Return Index. For illustrative purposes only. Past results do not guarantee future performance.

Data as of June 30, 2025. Source: PitchBook, Bloomberg, Westcourt analysis. Note: Global Equities is represented by MSCI World Net Total Return Index; Global Fixed Income by Bloomberg Global Aggregate Total Return Index. The “Global 30/40/30 Portfolio” is a hypothetical, unmanaged index and comprises 30% MSCI World Net Total Return Index, 40% Bloomberg Global Aggregate Total Return Index, and 30% Global Private Equity. The “Global 60/40 Portfolio” is a hypothetical, unmanaged index and comprises 60% MSCI World Net Total Return Index and 40% Bloomberg Global Aggregate Total Return Index. For illustrative purposes only. Past results do not guarantee future performance.

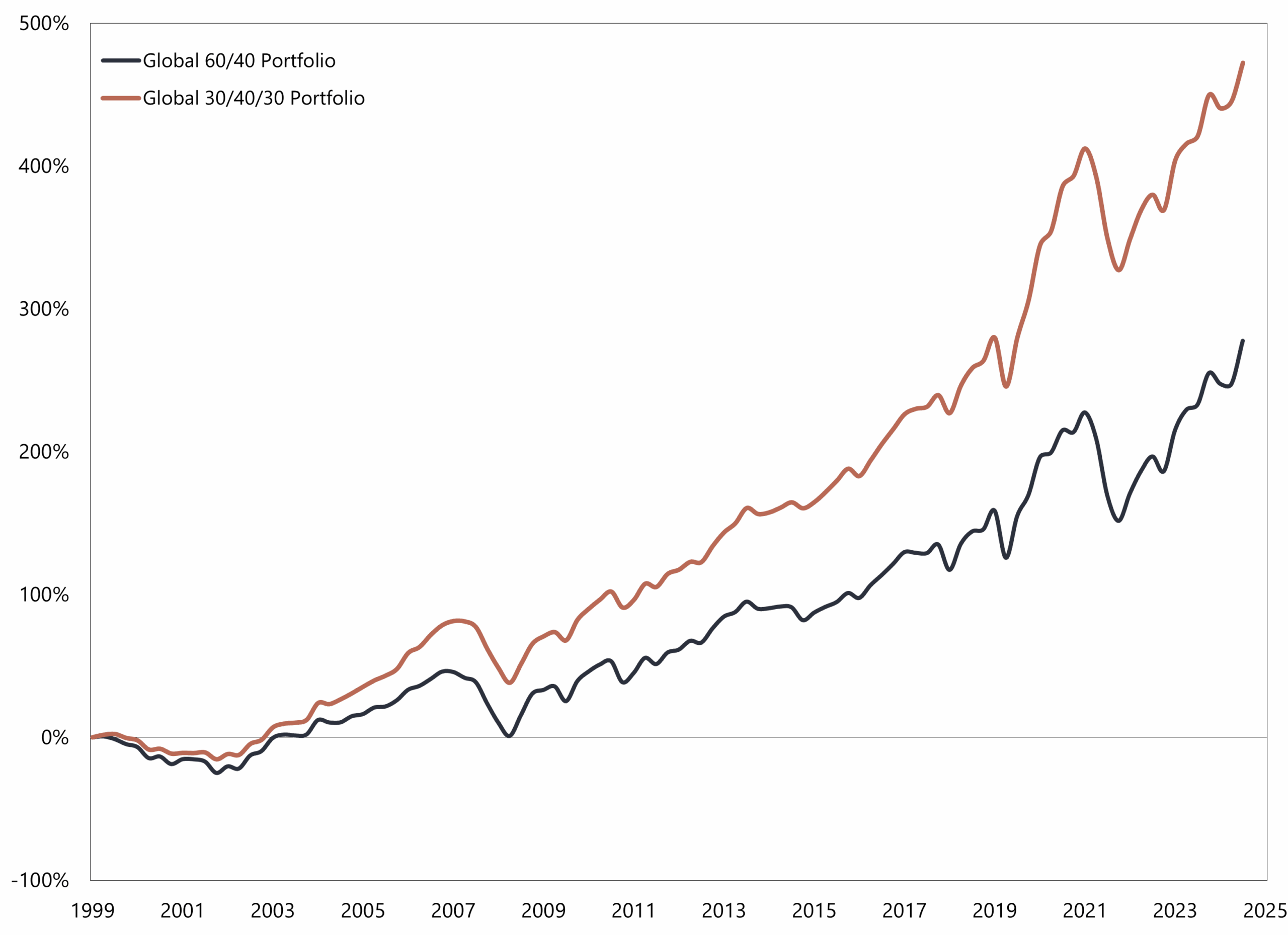

Data as of June 30, 2025. Source: PitchBook, Bloomberg, Westcourt analysis. Note: The “Global 30/40/30 Portfolio” is a hypothetical, unmanaged index and comprises 30% MSCI World Net Total Return Index, 40% Bloomberg Global Aggregate Total Return Index, and 30% Global Private Equity. For illustrative purposes only. Past results do not guarantee future performance.

Data as of June 30, 2025. Source: PitchBook, Bloomberg, Westcourt analysis. Note: The “Global 30/40/30 Portfolio” is a hypothetical, unmanaged index and comprises 30% MSCI World Net Total Return Index, 40% Bloomberg Global Aggregate Total Return Index, and 30% Global Private Equity. For illustrative purposes only. Past results do not guarantee future performance.