The Evolution of Private Markets:

Key Takeaways

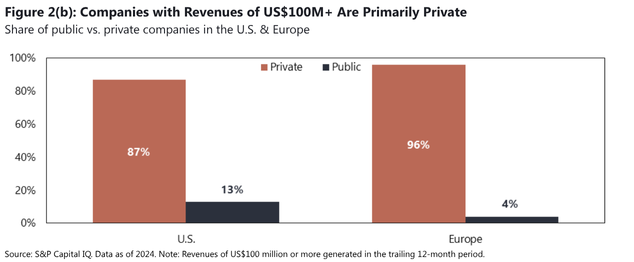

- Private markets are an extensive and largely untapped opportunity for individual investors, representing the majority of larger companies in both the U.S. (87%) and Europe (96%).

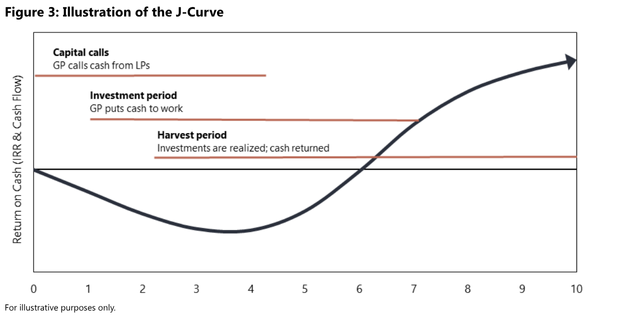

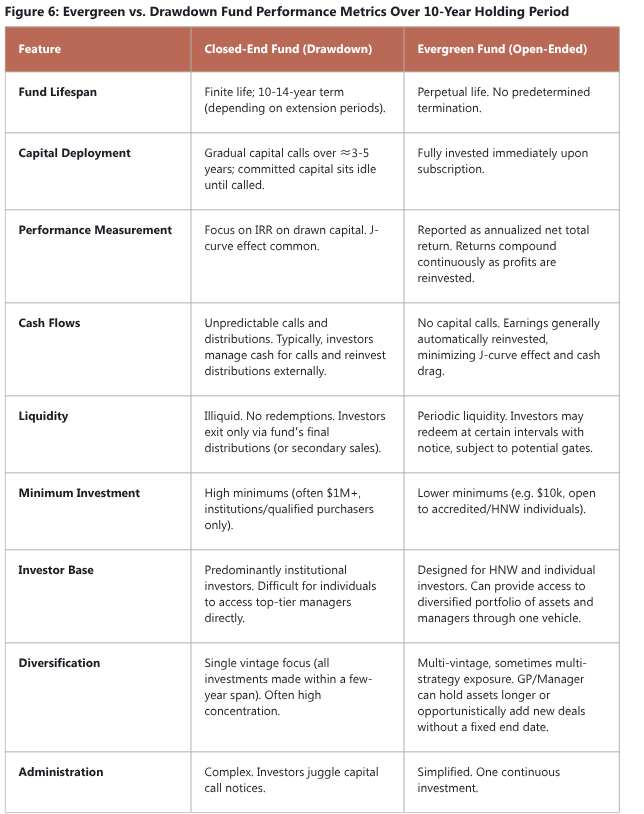

- Traditional drawdown funds have significant limitations for individual investors, including long lock-up periods, unpredictable capital calls, high investment minimums, portfolio concentration, the “J-curve” effect, and higher total fees due to generally higher performance fees.

- Evergreen funds are structured as open-ended, perpetual vehicles that address and solve for many of the drawdown model’s challenges. Evergreen vehicles continuously accept new subscriptions and offer periodic redemptions, typically on a monthly or quarterly basis.

- Evergreen funds offer major advantages for HNW and affluent investors, such as lower, more manageable minimums, immediate investment of capital which mitigates the J-curve, built-in diversification across vintages, companies and sectors, and improved liquidity and flexibility compared to drawdown funds.

- The evergreen structure is operationally simpler for investors, acting as a “one-ticket solution” that avoids the complexity of managing capital calls and distributions.

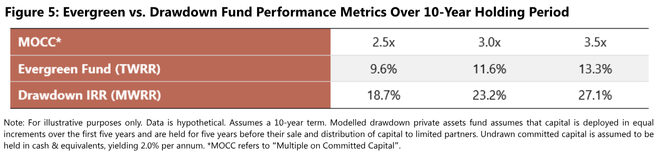

- Performance measurement differs between the two fund structures. Drawdown funds focus on internal rate of return, which is money-weighted and influenced by cash flow timing. Evergreen funds are better measured by time-weighted returns, which reflects continuous compounding from day one and can lead to superior long-term wealth creation.

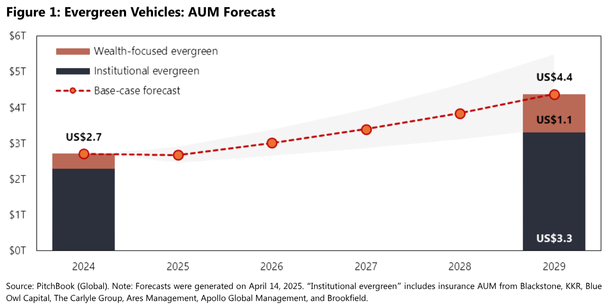

- According to PitchBook, the market for evergreen funds is growing rapidly, with assets projected to increase from US$2.7 trillion in 2024 to US$4.4 trillion by 2029, driven by demand from the private wealth channel.

Executive Summary

Private markets, which make up a significantly larger portion of the economy than public markets (82% of total U.S. employment1) and encompass roughly three times more companies in the U.S., represent a vast and historically inaccessible segment of the broader investment landscape. Access was traditionally restricted to large institutions via closed ended “drawdown” funds, a structure where investors commit capital upfront that is then drawn (or “called”) by the fund’s manager over time as investments are made. Drawdown funds are characterized by very high minimum investments, long lock-up periods, unpredictable capital calls, concentrated portfolios, and a “J-curve” performance drag.

Today, the market is evolving with the rise of evergreen funds. These open-ended, ‘perpetual’ vehicles offer a modern solution, providing greater flexibility, accessibility, and operational simplicity. Unlike traditional drawdown funds with a fixed lifespan, evergreen structures are continuously open to new capital and operate indefinitely, much like a public mutual fund. For investors, this means lower investment minimums, immediate exposure to a diversified portfolio, mitigated J-curve effects, and the power of continuous compounding from day one.

For managers, evergreen vehicles provide a stable, perpetual pool of capital, allowing them to avoid forced asset sales and deploy funds opportunistically. In contrast, the structural fixed lifespan of drawdown funds makes them vulnerable to forced asset sales. As reflected in Figure 1, assets in evergreen vehicles are projected to grow from US$2.7 trillion in 2024 to US$4.4 trillion by 20292. With supportive regulatory shifts domestically like Ontario’s proposed Long-Term Asset Funds (OLTFs)3, these structures are at the forefront of democratizing private market access for high-net-worth (HNW) and mass-affluent investors. This growth has been fueled by asset managers turning to the private wealth channel, including family offices, investment advisors, and affluent individuals, as large institutional investors reach their allocation limits. This momentum is further supported by the “Great Wealth Transfer,” which is expected to move an estimated US$124 trillion4 to a new generation of heirs who will look to accessible, modern investment solutions. The simpler, more accessible structure of evergreen funds is a natural fit for this expanding investor base.

Introduction

Opportunities in the Private Markets

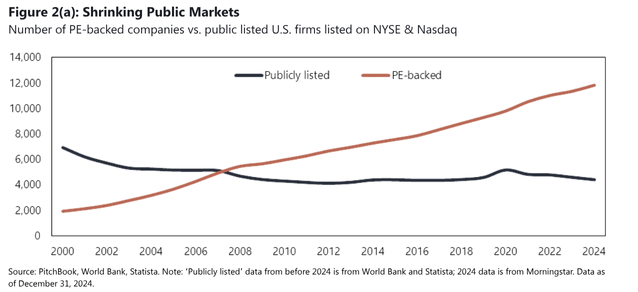

The investment landscape has fundamentally shifted, with the universe of public companies shrinking while opportunities in private markets simultaneously expand. This structural shift is illustrated in Figure 2(a). Over the past two decades, the number of publicly traded firms have steadily declined, while the number of private companies has swelled. Furthermore, the public markets now represent only a fraction of the businesses that fuel the economy. For instance, as shown in Figure 2(b), 87% of companies with revenues over US$100 million in the U.S. are private, a figure that rises to 96% in Europe.

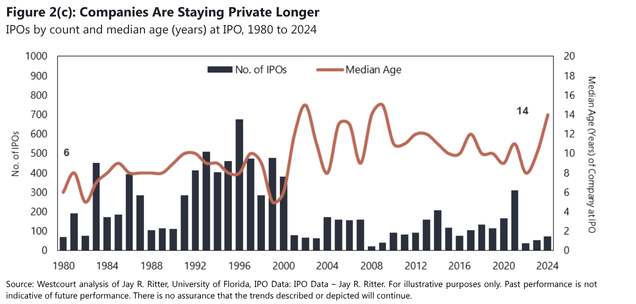

A key driver of this shift is that companies are staying private for longer to build operational value before going public. As a result, the median age of a company at IPO has more than doubled, increasing from six years in 1980 to 14 years in 2024, as highlighted in Figure 2(c). This means a significant portion of a company’s high-growth, value-creation period occurs while it is private, an opportunity that public equity investors have historically captured.

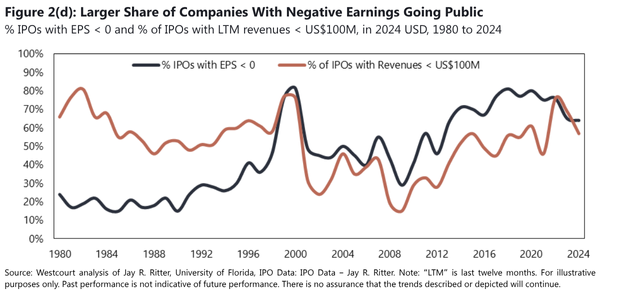

This challenges the common misconception that only the largest and most successful companies go public. As illustrated in Figure 2(d), a larger proportion of companies have been making their public debut while still being unprofitable and generating less than US$100 million in revenues. This might suggest that, while public markets remain a central source of capital, the private markets often represent a larger investable universe of more mature, fundamentally sound businesses.

Put simply, firms might choose to stay private for longer because the trade-offs increasingly appear to favour privacy and control. Deep pools of private capital can finance late-stage growth on attractive terms, while secondaries programs and tender offers may offer liquidity for founders, employees, and early investors without a public listing. Remaining private might help companies avoid the costs of quarterly analyst scrutiny, heavier disclosure obligations, underwriter fees, and the typical ‘IPO discount,’ which can preserve long-term decision-making. Limited disclosure may also serve as a shield that keeps playbooks out of competitors’ hands and reduces the pull to manage for short-term optics.5 With IPO windows opening and closing unpredictably, it is reasonable that many companies choose to build more value before entering public markets.

Traditional, Closed-Ended Drawdown Funds and Their Limitations

Historically, accessing opportunities in the private markets was a privilege reserved for institutional and ultra-high-net-worth investors. The primary vehicle was the traditional ‘drawdown’ fund, which is typically structured as a closed-ended limited partnership with a finite life of 10 to 14 years (depending on pre-agreed upon extension periods). In this model, investors (Limited Partners or LPs) commit capital to the fund which the manager (General Partner or GP) calls or draws down over several years to make investments.

While this model has historically delivered strong returns, it presents significant drawbacks for retail and HNW investors, including:

- Long lock-up periods: Capital is typically tied up for at least a decade. Investors must be prepared to go without access to their invested money for this entire period. While a private secondary market exists for investors to sell their stakes, the process is often slow, complex, and can force sellers to accept a significant discount to the fund’s net asset value (NAV), making it a costly and inefficient exit strategy for most individuals.

- Unpredictable capital calls: Investors must remain prepared and keep capital ready to meet unpredictable funding requests from the GP. This creates uncertainty and means a portion of an investor’s assets must remain in cash or low-yield, liquid accounts, waiting to be called. This uninvested, idle capital creates a “cash drag” that can lower an investor’s overall portfolio return.

- High minimums: Minimum commitments of $1 million or more are common, creating a high barrier to entry. Even for investors who can meet the high financial minimums, access isn’t guaranteed. The top-performing private assets managers are often oversubscribed and can be highly selective about their investors. They tend to favor large institutional clients like pension funds and endowments, making it very difficult for individual HNW investors to secure a spot in these premier funds.

- Concentrated: Because capital is deployed over a short investment period (typically 3 to 5 years), a drawdown fund’s portfolio is concentrated in a single vintage (the year the fund makes its first capital call). This exposes investors to the market conditions of that specific period. Furthermore, these funds often hold only a handful of portfolio companies, leading to concentration in a small number of sectors or industries.

- Higher all-in fees: The traditional “2 and 20” fee model, where a 2% management fee is often charged on committed capital (not just invested capital) and a 20% performance fee is taken on profits, can potentially lead to a drag on returns.6 This structure often results in a higher total expense ratio compared to evergreen funds, which typically charge a simpler management fee on NAV and may offer more favourable performance fee structures, ultimately leaving more of the return for the end investor.

- The “J-curve”: As illustrated in Figure 3 below, this refers to the significant and often prolonged period of negative returns that investors experience in the fund’s first three to five years. This initial “dip” can be a difficult experience, driven by a combination of factors, including (i) management fees generally charged upfront on the entire capital commitment, even while all or a large portion of the commitment remains uncalled; (ii) uninvested capital can create a “cash drag” by sitting idle in the investor’s low-yield accounts; and (iii) as the fund finally deploys capital, it can incur substantial upfront transaction costs for legal, advisory, and due diligence, which are immediately expensed to the fund. As investments also require years to mature before showing gains, investors are often left enduring negative (or flat) returns on their statements for extended periods, all while their capital is locked up and they are paying fees on uninvested money. This can create a significant psychological and financial drag that is unsuitable for many investors seeking efficient, compounding growth.

A Deeper Dive on Evergreen Private Markets Funds

Overview and Core Characteristics

In response to these limitations, the private markets are evolving. A growing share of non-institutional capital is now flowing into evergreen funds, which are open-ended investment vehicles with a perpetual lifespan (no fixed termination date). Unlike traditional funds that have a defined lifecycle (typically 10 to 14 years), comprised of raising capital, investing, harvesting, and liquidating, an evergreen fund operates as a perpetual pool of assets. It continuously accepts new subscriptions and allows investors to redeem at periodic intervals, typically monthly or quarterly. This structure allows the fund to hold attractive assets indefinitely, without the pressure of arbitrary fund deadlines, and enables investors to align their investment horizon with their financial goals.

Structural Mechanics

- Investment process: When an investor subscribes to an established evergreen fund, their capital is invested immediately into an existing, diversified portfolio of assets. This eliminates the long and uncertain wait associated with capital calls in drawdown funds and minimizes cash drag. The fund manager can redeploy capital from exited investments to make new ones, ensuring the portfolio remains fully deployed.

- Liquidity mechanisms: While evergreen vehicles offer greater liquidity than closed-ended funds, they are not as liquid as mutual funds or ETFs. To manage outflows and protect remaining investors from forced asset sales to satisfy redemptions, these funds use liquidity management tools. Common mechanisms include redemption “gates”, which may cap (or, limit) total redemptions to a certain percentage of the fund’s NAV (e.g., 5%) or outstanding units in any given quarter, and initial lock-up periods (e.g., one year) where redemptions are either not permitted or subject to an early exit penalty.

- Valuations: Investments are valued periodically (e.g., monthly or quarterly) to determine the fund’s NAV, which forms the basis for subscriptions and redemptions. Managers must have robust and consistent policies and procedures, with appropriate levels of oversight, in place in order to accurately and fairly adjudicate the value its portfolio assets.

- Legal structures: In Canada, evergreen funds often use a tax trust that qualifies as a mutual fund trust under the Income Tax Act. This structure is advantageous because it allows an investment in the fund to be held in registered plans like RRSPs and TFSAs, broadening their appeal to mass affluent and high-net-worth investors. It also provides tax efficiency at the fund level by allowing income and capital gains to “flow through” to unitholders, who typically receive a T3 slip for tax reporting purposes.

Advantages of Evergreen Private Markets Funds

Evergreen vehicles address many of the fundamental challenges posed by traditional closed-ended funds, offering a more modern and investor-friendly experience.

- Improved liquidity and flexibility: Unlike the 10+ year lock-up in drawdown funds, evergreen vehicles offer periodic liquidity, typically on a monthly or quarterly basis, subject to early redemption penalties or gates. This gives investors the flexibility to access their capital without being forced to hold on until the fund’s arbitrary end date.

- Reduced operational burden and administrative ease: The traditional model requires investors to manage unpredictable capital calls and a stream of distributions across multiple funds of different vintages. An evergreen fund simplifies this dramatically, acting as a “one-ticket solution” where a single subscription provides exposure to the private markets without the hassle of managing cash flows (e.g., capital calls and distributions).

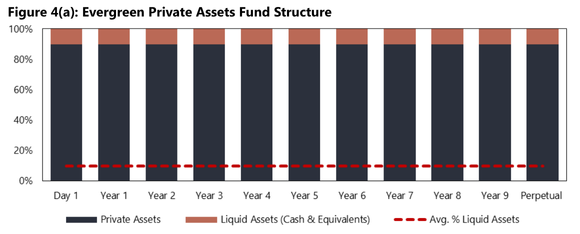

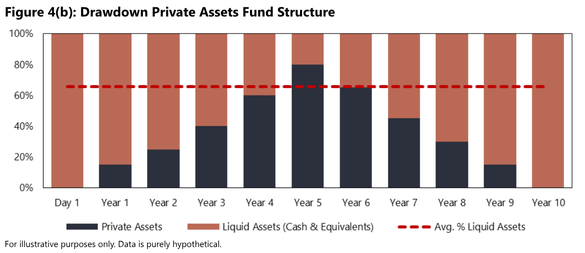

- Immediate exposure & mitigated J-Curve effect: As illustrated in Figure 4(a), capital in an evergreen fund is typically invested up-front into a pre-existing, mature portfolio. This immediate deployment means investors’ money starts compounding from day one, avoiding the “cash drag” exhibited in drawdown funds. Cash drag is a more significant issue in traditional drawdown funds (refer to Figure 4(b)), as capital is called gradually over several years. In bypassing the slow initial investment period, evergreen funds effectively mitigate the J-curve’s early negative returns.

- Built-in diversification: A single investment in an evergreen fund provides instant exposure to a portfolio that is already diversified across different vintages, sectors, and strategies. This is a significant advantage over the traditional closed-ended approach, which would require investors to commit to many different funds over several years to achieve similar diversification.

- Alignment with long-term goals: Evergreen funds allow managers to hold high-quality, high conviction assets for the long term, avoiding forced sales at inopportune times due to a fund’s fixed lifespan. This focus on long-term value creation aligns with the objectives of wealth preservation and steady growth. Furthermore, a fund in Canada that is structured as a trust enables tax-efficient investing, particularly through registered accounts.

- Broader accessibility for investors: Perhaps the most significant advantage is the democratization of private markets. While traditional funds required million-dollar-plus commitments, evergreen funds often have much lower minimums (sometimes $10,000 or less), making them accessible to a broader base of high-net-worth and mass-affluent investors for the first time.

Performance Measurement: Compounding vs. Internal Rate of Return

One of the most compelling benefits of evergreen funds is the impact of being invested on day one and staying fully invested until time of redemption. In a traditional drawdown fund, capital is called gradually over several years, meaning a large portion of committed capital sits idle early on. In contrast, evergreen funds put capital to work from day one, allowing returns to compound uninterrupted.

Closed-ended drawdown funds are often measured by their internal rate of return (IRR), which can appear to be deceptively high for some strategies. Furthermore, IRR is a money-weighted return that can be heavily influenced by the timing of cash flows and only measures the performance of invested capital (and not committed capital). Evergreen funds, being perpetual and fully invested, are better measured by time-weighted rate of return (TWRR), similar to public market securities, like stocks or ETFs. While this may result in a lower stated annual return figure relative to IRR, the benefit of continuous compounding from day one can potentially lead to superior long-term wealth creation.

Figure 5 below illustrates this key difference in performance measurement between the two structures. It shows the higher comparable IRR that a traditional drawdown fund would need to generate just to achieve the same investment multiple for a given evergreen return.

Challenges and Considerations for Evergreen Funds

While evergreen funds offer compelling advantages, investors should also be aware of their unique characteristics and potential challenges.

- Liquidity management: The periodic liquidity offered by evergreen funds is a key feature, but it is not guaranteed. During periods of significant market stress or uncertainty, if redemption requests exceed the fund’s gates (e.g., 5% of NAV per quarter), investors may face redemption queues or suspensions. This liquidity is a feature of convenience, not an emergency exit, and investors must be prepared for the illiquid nature of the underlying assets. Fund managers should have a robust liquidity management program in place in order to successfully manage a viable evergreen platform over the long-term.

- Valuation complexity: The underlying assets in private market funds are illiquid and do not have daily market prices. Valuing these assets to strike a NAV requires robust internal processes and third-party oversight. This complexity can lead to valuation uncertainties compared to publicly traded securities.

- Fee structure differences: Fee structures can vary across fund structures. While traditional drawdown funds often charge fees on committed capital (even if it is undrawn), evergreen funds typically charge fees on NAV.

- Manager expertise and track record requirements: The evergreen model requires a different skill set than managing a drawdown fund. GPs must be skilled at continuously sourcing new deals, managing liquidity, and communicating a NAV consistent with the prevailing valuations of portfolio assets. Investors should seek out managers with a proven track record, coupled with the institutional infrastructure, to manage a perpetual vehicle effectively.

Final Thoughts

The private markets landscape in Canada is undergoing a fundamental transformation, shifting away from the institutional-focused drawdown model toward the more flexible and accessible evergreen structure. Evergreen funds effectively address the traditional limitations of high minimums, long lockups, and unpredictable capital calls by offering a more investor-friendly, open-ended solution. For high-net-worth and mass-affluent investors, this evolution provides a powerful tool for achieving immediate, diversified exposure to private assets while benefiting from the power of continuous compounding. As these vehicles continue to grow in prominence, supported by investor demand and regulatory advancements, they have become a core component in building resilient, long-term portfolios, helping investors achieve their financial goals.

Footnotes

[1] U.S. Bureau of Labor Statistics, Bloomberg, Apollo Chief Economist. Data as of 2023.

[2] PitchBook, “2029 Private Market Horizons”, May 1, 2025.

[3] Ontario Securities Commission, “Opportunity to Improve Retail Investor Access to Long-Term Assets through Investment Fund Product Structures, October 10, 2024.

[4] Cerulli Associates, “Cerulli Anticipates $124 Trillion in Wealth Will Transfer Through 2048”, December 5, 2024.

[5] Ares Management, “’IRRational’ Thinking: How the IRR Reinvestment Rate Myth Is Distorting Investment Decisions.

[6] StepStone Group. A comprehensive guide to private equity investing.